Security Board of Nepal (SEBON) is the authorized government body to approve the IPO issue of the public limited company. There are different companies waiting to issue IPO to the general public. Likewise, the Security Board of Nepal has approved the IPO issue of different companies which we are going to discuss now. There are many companies which are in the pipeline of SEBON to issue IPO to the general public.

River Falls Limited

Rivers

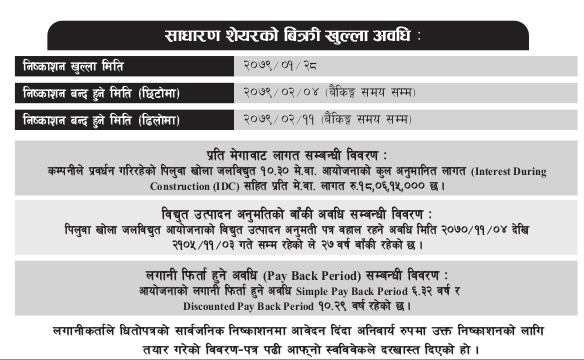

Falls limited is all set to issue IPO

to the general public from 11th May, 2022. The company is going to

issue twenty-seven lakhs and thirty thousand unit IPO. Among 2730000 shares 2%

or 54,600 units have been secured for the company employees and 5% or 136,500

units for mutual funds. The general public will be able to apply from 10 units

to 1 lakh units. The IPO application will open at 11th May to 18th

may 2022.

Investors

can apply to the IPO from the meroshare application. if you are not

meroshare user, you can apply IPO from the ASBA member bank

Company Info

River

Falls Hydropower Pvt. Ltd. was established as a Pvt. Ltd Company in October,

2004 under the Company Act 1993 of Nepal by a group of entrepreneurs and later

on converted into Public Ltd Company in October, 2015. The company works

towards the electrification of the nation by supporting government by producing

the electricity. Energy is a basic means meeting both the basic requirements of

life support system and executing all development efforts. The company thus has

planned to contribute towards the solution of present power shortage by

developing hydropower projects as well to contribute towards the rural economic

development of Nepal.

This

company is constructing 10.30 Megawatt Piluwa Khola Hydropower with the

estimated cost Rs 180,615,000 including interest.

IPO Notice of Rivers Falls limited Click Here

IPO Pipeline in Nepal

| S.N | Company Name | IPO Units |

|---|---|---|

| 1. | Kalinchowk Darshan Limited | 1,200,000 |

| 2. | Aatmanirbhar Laghubitta Bittiya Sanstha | 203,380 |

| 3. | Hathway Investment Nepal Ltd | 2,925,000 |

| 4. | City Hotel Limited | 1,674,000 |

| 5. | Aviyan Laghubitta Bittiya Sanstha Ltd. | 975,000 |

IPO Approved in Nepal

| S.N | Company Name | IPO Units |

|---|---|---|

| 1. | Himalayan Hydropower Limited | 2,250,000 |

| 2. | Bindhyabasini Hydropower Development Co. Ltd. | 2,500,000 |

Muktinath Krishi Company Limited is going to issue IPO to the general public. Recently this company is on the pipeline of Security Board of Nepal. This company is planning to issue 4,00,000 unit shares to the general public. Muktinath Krishi Company Limited has appointed Mega capital market as the IPO issue manager. This company is the sister organization of Muktinath Bikash Bank.

Upcoming Initial Public Offering (IPO) in 2022

SEBON has given the approval to issue IPO (for locals and the public)to the six public limited companies on 24th January 2022. The details of the IPO-approved company are as follows.

Securities Board of Nepal (Nepal Dhitopatra Board) recently approved the Initial public offering (IPO) of the six companies. Out of six companies, three are microfinance (laghubitta), two are hydropower companies and one is an investment company. The date of IPO approval is 26th January 2022. After the approval, these six companies are eligible to issue IPO to the general public. There will be many IPO issued in the year 2022. There are many public limited companies are in pipeline of SEBON waiting to issue IPO to the general public. Only after the SEBON approval companies are eligible to issue IPO to the general public.

What is an initial public offering (IPO)?

Initial Public Offering (IPO) means issuing common stock at the primary market. The primary market is the place where the stocks are created. There are two types of share market one is the primary market and another is the secondary market. The primary market is the place where primary shares are created and issued. When a public limited company wants to increase its capital then the company will issue the IPO to the public. IPO is the newly issued share of common stock. The market where IPO is issued is known as the primary market.

How to give an application to purchase IPO in Nepal?

If you want to give an application to purchase IPO in Nepal, first of all, you have to make a bank account and Demat account. Nowadays CDSC Nepal has developed web-based application and mobile application which helps to give application to purchase primary shares/ IPO in Nepal. Due to the online system, it is very easy to give applications to purchase IPO in Nepal. All the commercial banks and many financial instructions which are giving ASBA service make it very easy to give applications to purchase IPO in Nepal.

Comments

Post a Comment