Jyoti Life Insurance IPO Issue Date, Jyoti life Insurance Ipo Issue, jlil ipo issue

Jyoti Life Insurance Limited (JLIL) has got the approval from security board of Nepal SEBON to issue the initial public offering. This life insurance company has got the approval from SEBON from 20 Feb.2021 to issue Primary (IPO) to the general public. Many Life insurance are in pipeline to issue the IPO to increase their paid-up capital.

The insurance companies which have already issued IPO to the general public are as follows.

- General Insurance Company Limited

- Ajod Insurance

- Sanima General Insurance Limited

- Reliance Life insurance Limited

- Prabhu life Insurance Limited

Upcoming IPO of Insurance/ life insurance companies are as follows

- Jyoti Life Insurance Company Limited

- IME Life Insurance Limited

Financial Highlight of JLIL

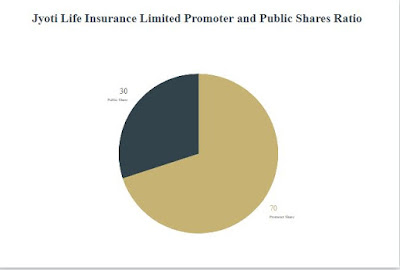

This company will issue sixty six lakh units shares to the general public which has 1.54 arba paid up capital now and it will be 2.20 Arba after IPO allotment.IPO Issue Manager of JLIL

The IPO issue manager of JLIL is NMB Capital Limited.

Comments

Post a Comment