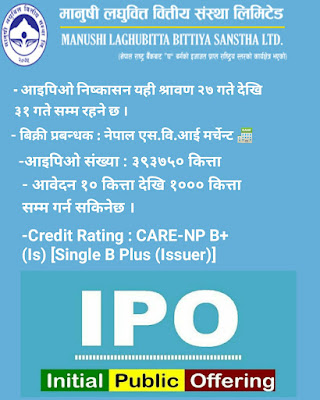

Manushi Laghubitta IPO Issue Details

Manushi Laghubitta Bittiya Sanstha Limited is going to open the application for the Initial Public Offering (IPO) from August 11th 2021 (2078 Shrawan 27). This company will issue 393750 units IPO.

How to Apply IPO

There is two easy process to apply the Initial Publc Offering (IPO)

- From ASBA Members Bank

- From Mero Share Software

| Company Name | Manushi Laghubitta Bittiya Sansatha Limited |

|---|---|

| IPO Issue Date | Shrawan 27th 2078 |

| Issue Manager | Nepal SBI Merchant Banking Limited |

| Credit Rating | Care NP B+ Issue |

| Total Issued IPO | 393750 Kitta |

| For Employees | 5649 Kitta |

| For Mutula Fund | 19688 Kitta |

| For General Public | 368593 Kitta |

| Limit Kitta for Application | 10 kitta - 1000 Kitta |

| IPO early Closing Date | 31st Shrawan, 2078 |

| Late Closing Date | 9th Bhadra, 2078 |

About Sanima Life Insurance Company Limited

Manushi micro finance program was commenced in April 2002 as a major program of Manushi which was established in 1991. Presently, Manushi Microfinance is registered under company act and got the D class bank license from Nepal Rastriya Bank in Ashoj 25, 2075 B.S.

Capital Status of Sanima Life Insurance Company Limited

| Total Paid-up Capital | 10.93 Crore |

|---|---|

| Promoters | 7 Crore |

| General Public | 3.93 Crore |

Comments

Post a Comment